OpenAI still leads enterprise AI, but Anthropic is gaining fast, according to new study

Key Points

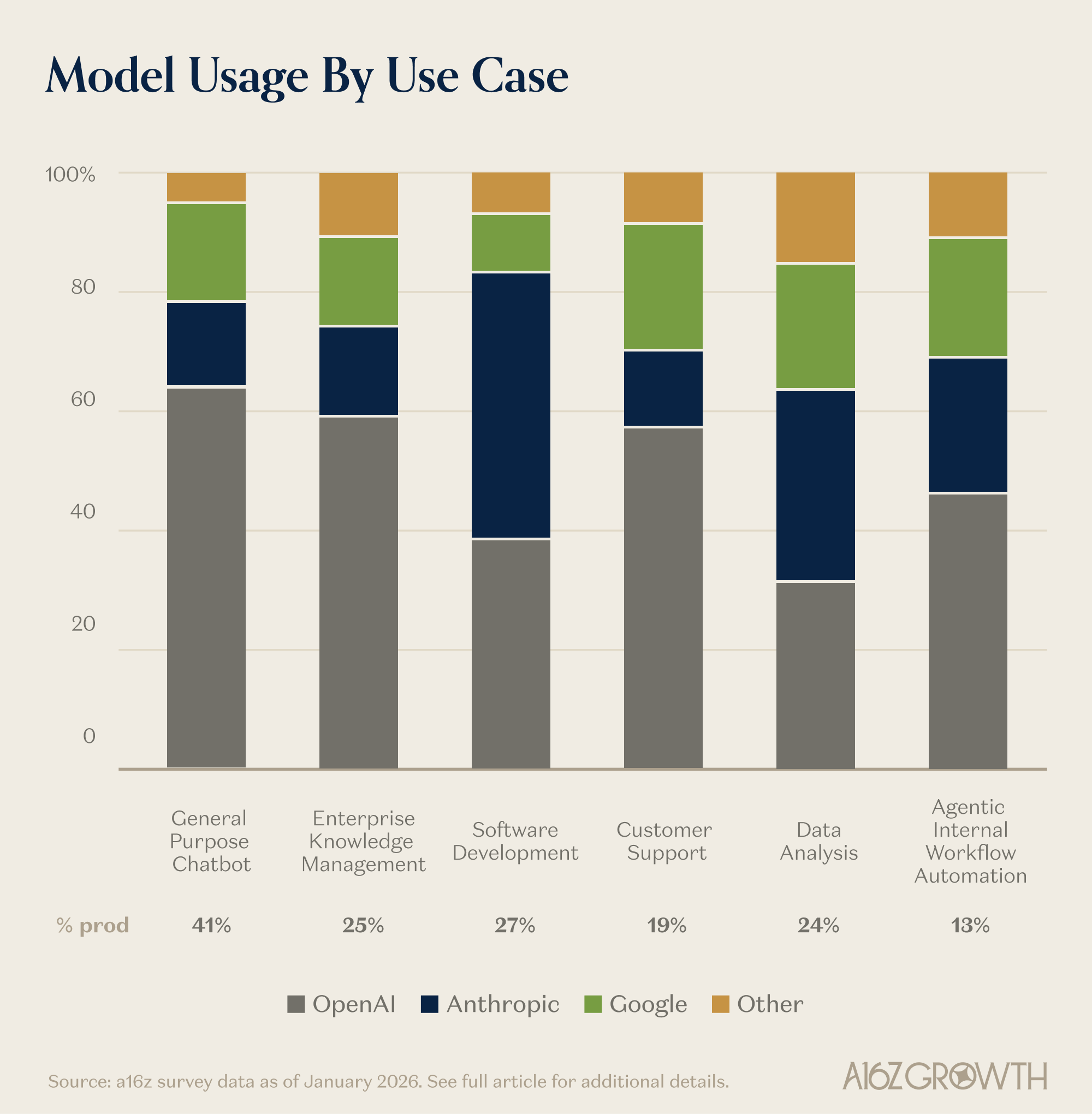

- A survey by venture capitalist Andreessen Horowitz of 100 CIOs from large companies reveals that OpenAI leads enterprise AI adoption with 78% usage in production, though Anthropic is gaining ground.

- The two AI providers show distinct strengths: OpenAI dominates in chatbots, knowledge management, and customer support, while Anthropic takes the lead in software development and data analysis applications.

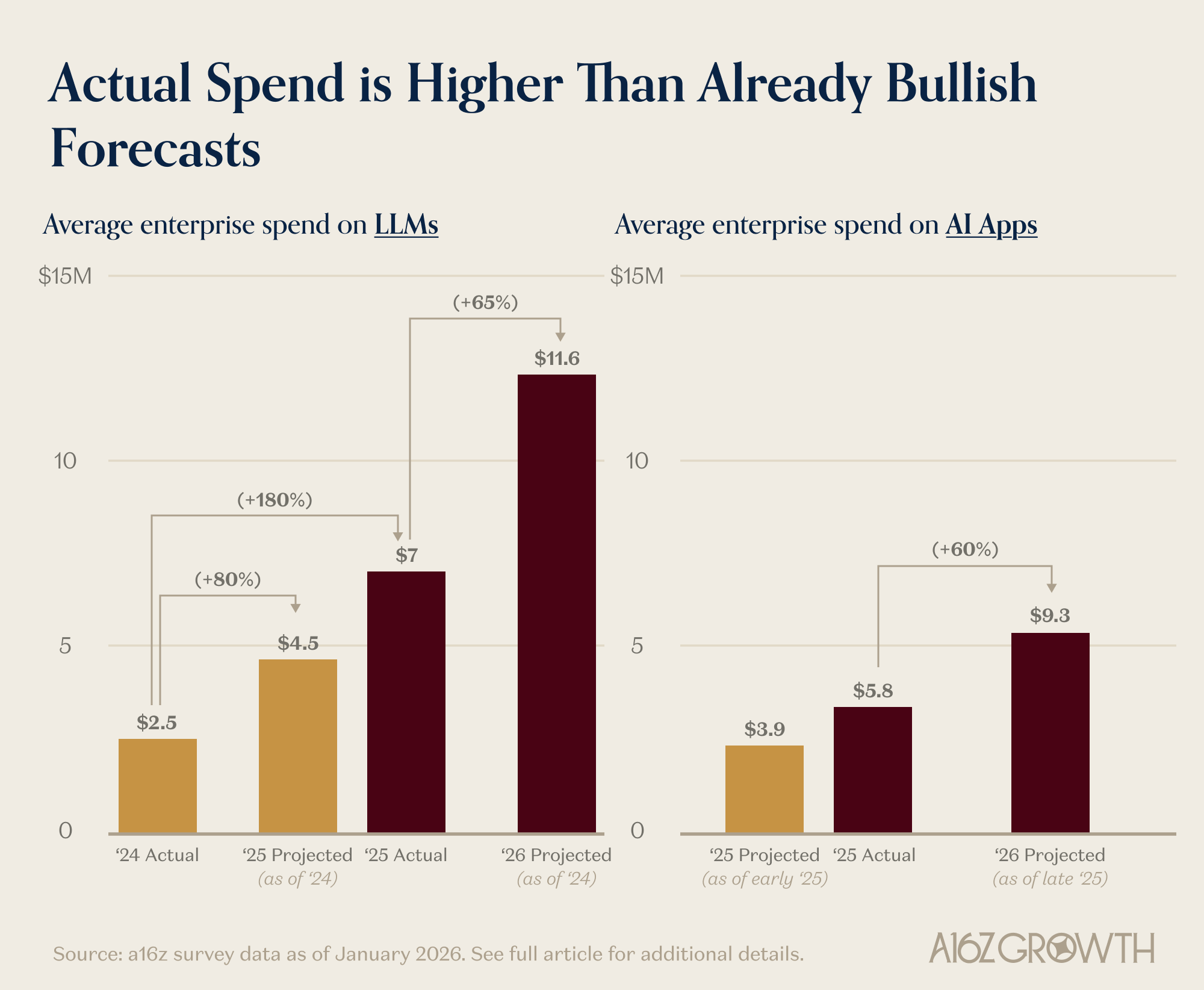

- Corporate spending on AI models surged by 180 percent to an average of $7 million in 2025, more than doubling previous forecasts.

A new survey of 100 CIOs from large companies shows OpenAI maintaining its lead while Anthropic and Google close the gap. Microsoft continues to dominate AI applications.

The enterprise AI market isn't fragmenting into many equal players as some predicted. Instead, it's consolidating into an oligopoly of a few dominant providers.

That's the key finding from the third annual CIO survey by venture capitalist Andreessen Horowitz (a16z), which polled 100 executives from Global 2000 companies with annual revenue of at least $500 million. A16z is an investor in OpenAI.

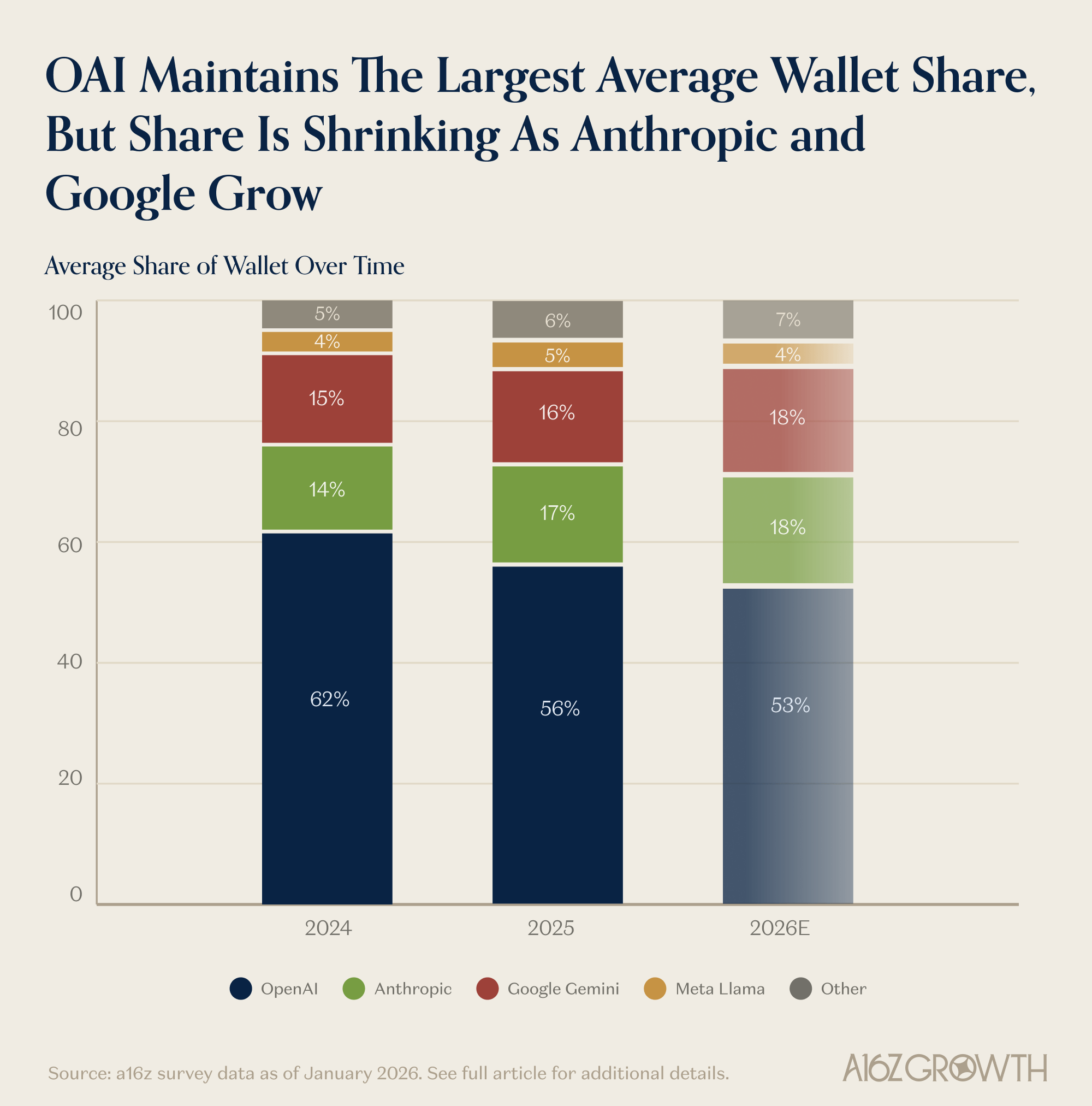

78 percent of surveyed companies now use OpenAI models in production. But Anthropic posted the biggest gains: since May 2025, its enterprise penetration jumped 25 percent to 44 percent. OpenAI still captures about 56 percent of total AI model spending, but that share is shrinking as Anthropic and Google gain ground. CIOs expect 2026 to shake out like this: OpenAI at 53 percent, with Anthropic and Google each at 18 percent.

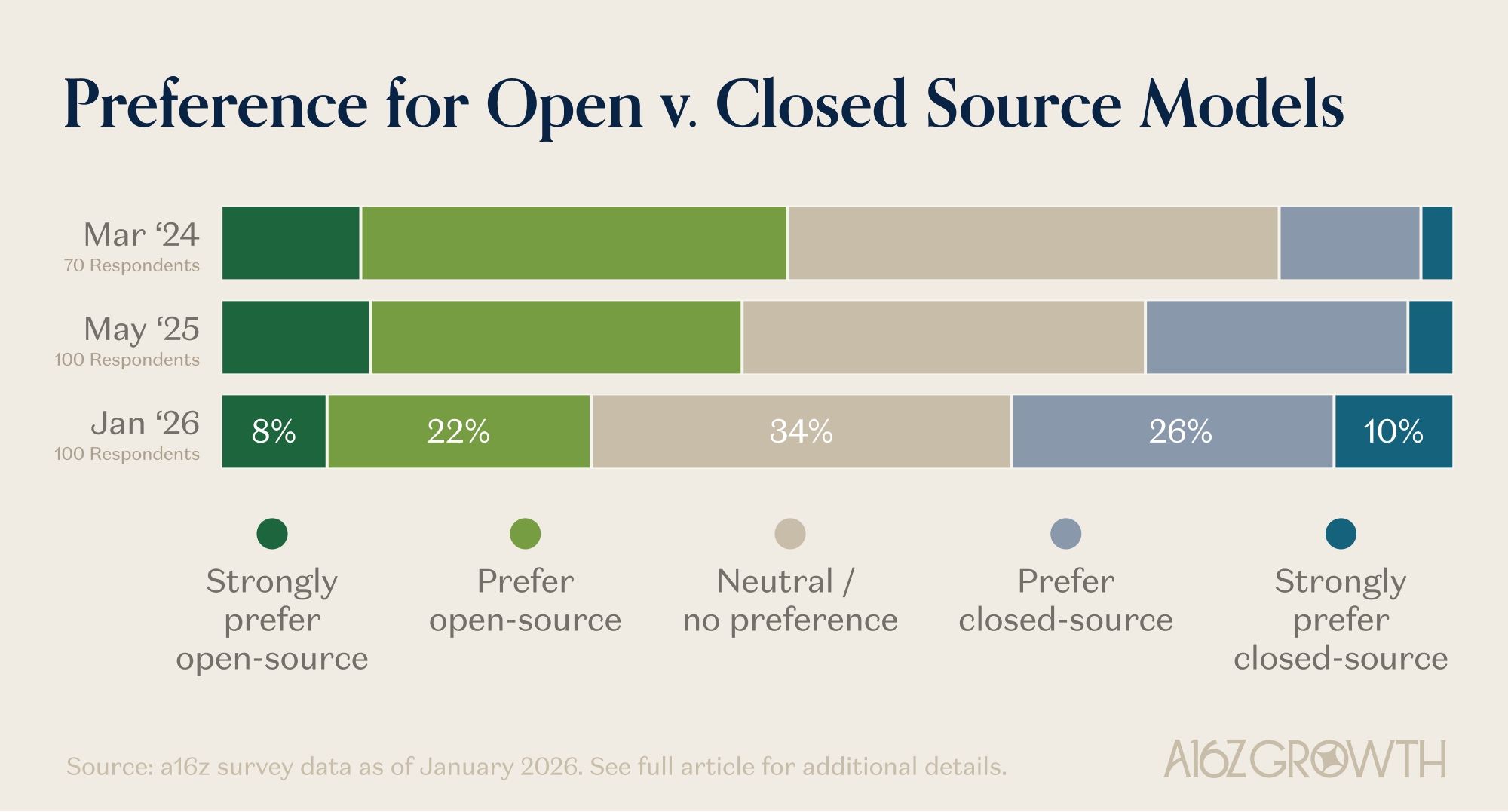

The much-anticipated open-source revolution hasn't hit enterprise AI. More than a third of surveyed companies prefer proprietary models, and that preference is growing. CIOs point to faster model improvements, limited in-house AI talent, and data security concerns. Trust in frontier labs like OpenAI and Anthropic has grown significantly over the past two years, according to the survey.

Anthropic leads in coding, OpenAI dominates chatbots

Market leadership shifts depending on the use case. OpenAI dominates early, horizontal applications like general chatbots, enterprise knowledge management, and customer support. Anthropic leads in software development and data analysis. CIOs say rapid capability improvements since the second half of 2024 drove adoption. Google Gemini performs well across many areas but falls way behind in coding.

Anthropic's gains come from its most advanced models. 75 percent of Anthropic customers run Sonnet 4.5 or Opus 4.5 in production. At OpenAI, only 46 percent of customers use the latest GPT 5.2 or 5.2 Pro models. Many companies stick with older models that "work well enough." 81 percent of companies now use three or more model families, up from 68 percent less than a year ago.

Enterprise AI spending blows past forecasts

Microsoft 365 Copilot dominates enterprise chat with more than 90 percent paid licenses among surveyed companies. GitHub Copilot remains the coding market leader at around 70 percent. Salesforce Agentforce, ServiceNow AI Agents, Google Workspaces, and Workday AI trail with much lower adoption rates, though they show stronger growth potential in the "evaluating" stage.

65 percent of surveyed companies prefer solutions from established vendors, citing trust, better integration with existing systems, and easier procurement. Still, a16z sees room for startups, since larger companies especially value faster innovation from AI-native providers.

Average enterprise spending on LLMs jumped from about $2.5 million in 2024 to about $7 million in 2025. That's 180 percent growth, more than double the 80 percent forecast. For 2026, surveyed companies expect another 65 percent increase to about $11.6 million.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe now