OpenAI's restructuring stalls as talks with Microsoft over API access and IP rights drag on

Key Points

- OpenAI's planned corporate restructuring, which would give investors real equity in the company for the first time, is delayed due to stalled negotiations with Microsoft over API access, intellectual property rights, and a controversial AGI clause.

- A key point of contention is OpenAI's exclusive hosting deal with Microsoft Azure; OpenAI wants more flexibility to partner with other cloud providers like Google and Amazon, but Microsoft is resisting, and only a limited compromise for government clients is being discussed.

- The outcome of these talks will impact OpenAI's future valuation and fundraising, with billions of dollars at stake, including SoftBank's $10 billion commitment and Microsoft's expected equity stake of 30–35 percent depending on the final agreement.

OpenAI's planned restructuring is on hold as negotiations with Microsoft over API access, intellectual property rights, and a disputed AGI clause stall, according to the Financial Times.

The overhaul, which would give investors real equity in OpenAI for the first time, is now expected to be delayed until next year. At the heart of the holdup are drawn-out talks with major investor Microsoft. These negotiations are critical for OpenAI's ability to raise new funding, including a possible $500 billion valuation. If no deal is reached by the end of 2025, Japanese tech giant SoftBank could pull its $10 billion commitment.

API access: OpenAI seeks flexibility, Microsoft resists

A major sticking point is OpenAI's exclusive hosting deal with Microsoft. Right now, Microsoft's Azure cloud is the only platform running OpenAI's AI models. OpenAI wants to loosen this arrangement to pursue additional partnerships with Google Cloud and Amazon Web Services, aiming to boost revenue from its API business. API access currently makes up about a quarter of OpenAI's $12 billion in annual recurring revenue.

Microsoft, according to the Financial Times, is not eager to give up its exclusive position. The companies are considering a narrow compromise that would let OpenAI serve government clients outside of Azure, but nothing has been finalized.

Training data, IP, and the AGI clause

Microsoft's future rights to OpenAI's intellectual property are also up for debate. It's unclear whether Microsoft will continue to have access only to finished models, or if it will get more insight into the training processes behind them.

One of the most contentious issues is a contractual AGI clause. The clause allows OpenAI to revoke Microsoft's access to its IP if Microsoft builds "artificial general intelligence" - in other words, a system that can outperform humans in most economically important tasks.

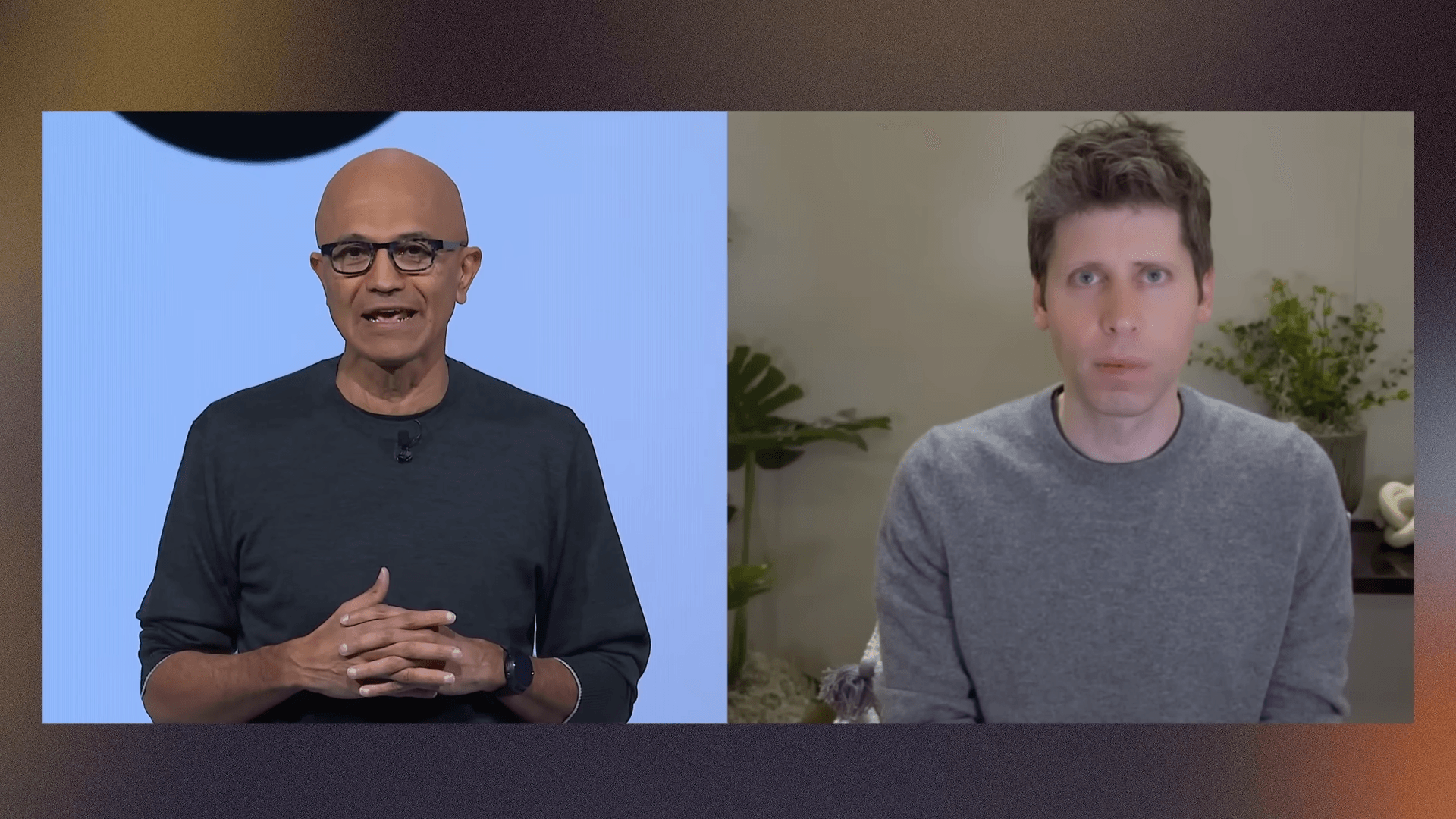

Microsoft CEO Satya Nadella wants to remove this clause entirely. OpenAI, for its part, wants to keep at least a weaker version of it. A person involved in the negotiations described the clause as a mutual deterrent that OpenAI uses as leverage.

Billions at stake

OpenAI is currently valued at around $300 billion, based on a SoftBank-led funding round in March. A previous round in October 2023 pegged the company at $157 billion. Both deals include clauses that let investors back out if OpenAI doesn't restructure in time.

The outcome of talks with Microsoft will also determine how much equity Microsoft gets after the restructuring. The current expectation is that Microsoft will own between 30 and 35 percent of OpenAI, depending on how negotiations play out.

Despite all the uncertainty, the most recent funding round was heavily oversubscribed, according to the Financial Times. OpenAI is also negotiating a secondary share sale that would value the company at $500 billion, which would significantly boost the value of SoftBank's original investment. A new primary funding round with an even higher valuation is also under discussion.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe now