The artificial intelligence industry is growing and maturing rapidly. As AI becomes more capital-intensive, companies are turning to creative forms of financing to fund expansion.

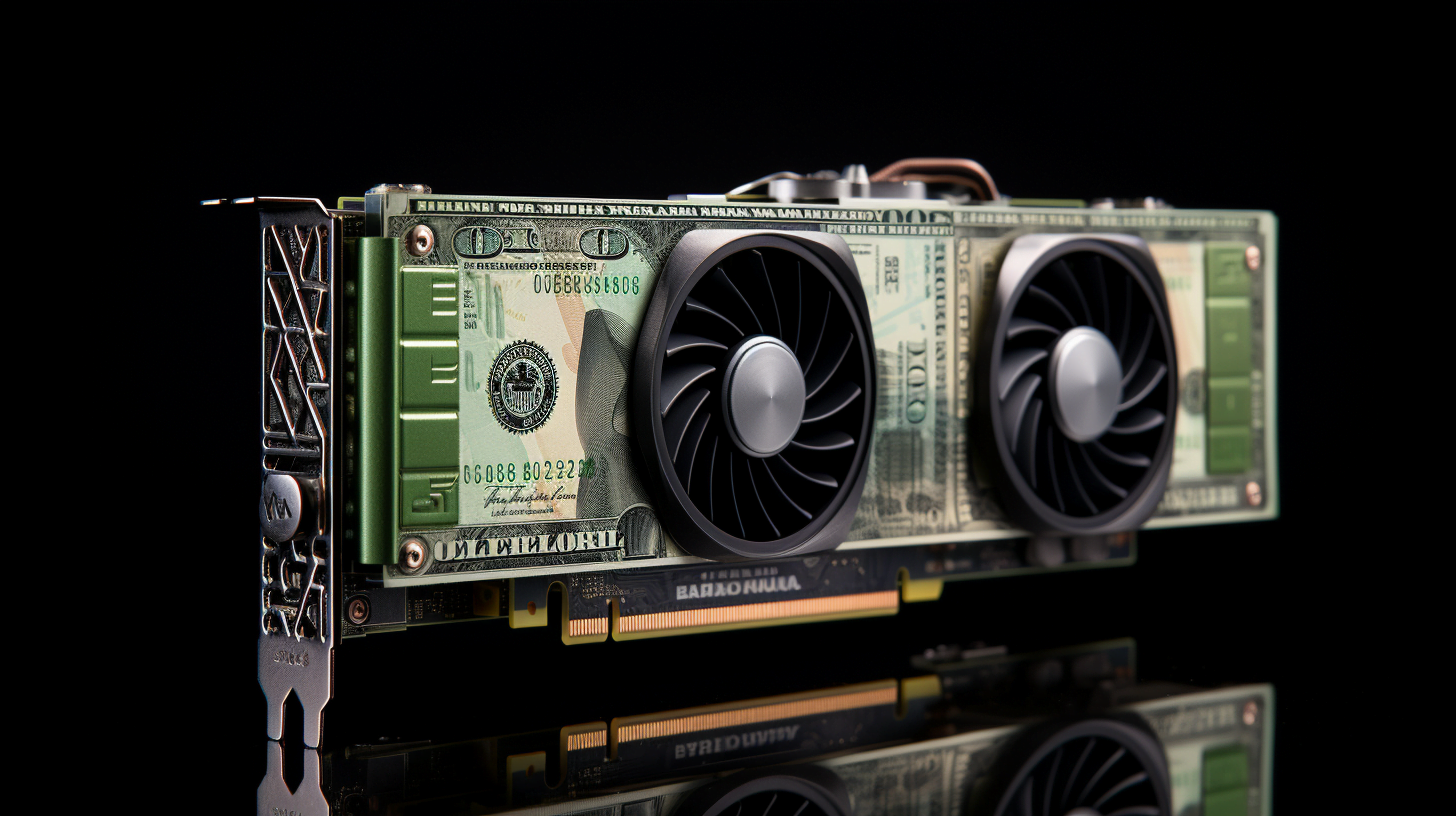

Cloud computing company CoreWeave recently raised $2.3 billion in debt financing by using its Nvidia H100 GPUs as collateral. The lenders include major investment firms like Blackstone, BlackRock, and Carlyle.

CoreWeave is backed by Nvidia and has unique access to the highly sought-after Nvidia chips. With GPUs in short supply, CoreWeave's access gives it an advantage over giants like Microsoft, Amazon, and Google as the next generation of AI supercomputers is coming online.

Using the GPUs as collateral provides lower-risk lending for investors. "We negotiated with them to find a schedule for how much collateral to go into it, what the depreciation schedule was going to be versus the payoff schedule," said Michael Intrator, CEO and co-founder of CoreWeave. "For us to go out and to borrow money against the asset base is a very cost effective way to access the debt markets."

New funding for data center expansion and hiring

CoreWeave plans to use the new funds to acquire more GPUs, build data centers, and hire staff. This will expand its ability to meet the rising demand for AI computing power.

Earlier this year, CoreWeave raised $421 million in equity financing at a $2 billion valuation. The company aims to have 14 data centers in the U.S. by the end of 2023.

"As AI has become an increasingly capital intensive enterprise, we're starting to see more of the 'forces of capital' flood into AI," said Jack Clark, co-founder of the AI startup Anthropic. "That means AI companies (and cloud providers) are going to start doing more complicated and weirder forms of financing, and it also means some of the infrastructure of AI (e.g, chips) and some of the demand signals (e.g, pre-committed customer contracts for allocations to cloud infrastructure) will become turned into financial instruments and further integrated into the rest of the capital economy.

Clark sees CoreWeave's funding move as part of the broader industrialization and maturation of the AI industry. Perhaps no company has benefited more from this than Nvidia, which had a market cap of $150 billion in 2020. Today, it is over $1 trillion.