Read full article about: AI video generator Pika Labs raises 80 million US dollars

AI video generator Pika Labs has raised $80 million, joining other AI video startups like Runway, HeyGen, and Synthesia that have also raised larger amounts of funding recently. Pika Labs' valuation jumped to $470 million after the funding round, which still lags behind Runway's $1.5 billion valuation. What sets Pika apart from the standard AI startup is that it's training its own foundational model. "We're very confident that we're building the best foundational model for video," Pika co-founder Demi Guo told the Washington Post. The 13-person team includes former AI researchers from Google, Meta, and Uber. Based on demos, OpenAI's Sora currently leads all other AI video generators by a wide margin - but is not yet publicly available. The same goes for Google's video generator.

Comment

Source: Washington Post

Read full article about: OpenAI CEO Sam Altman's chip plans were 'too aggressive' for TSMC

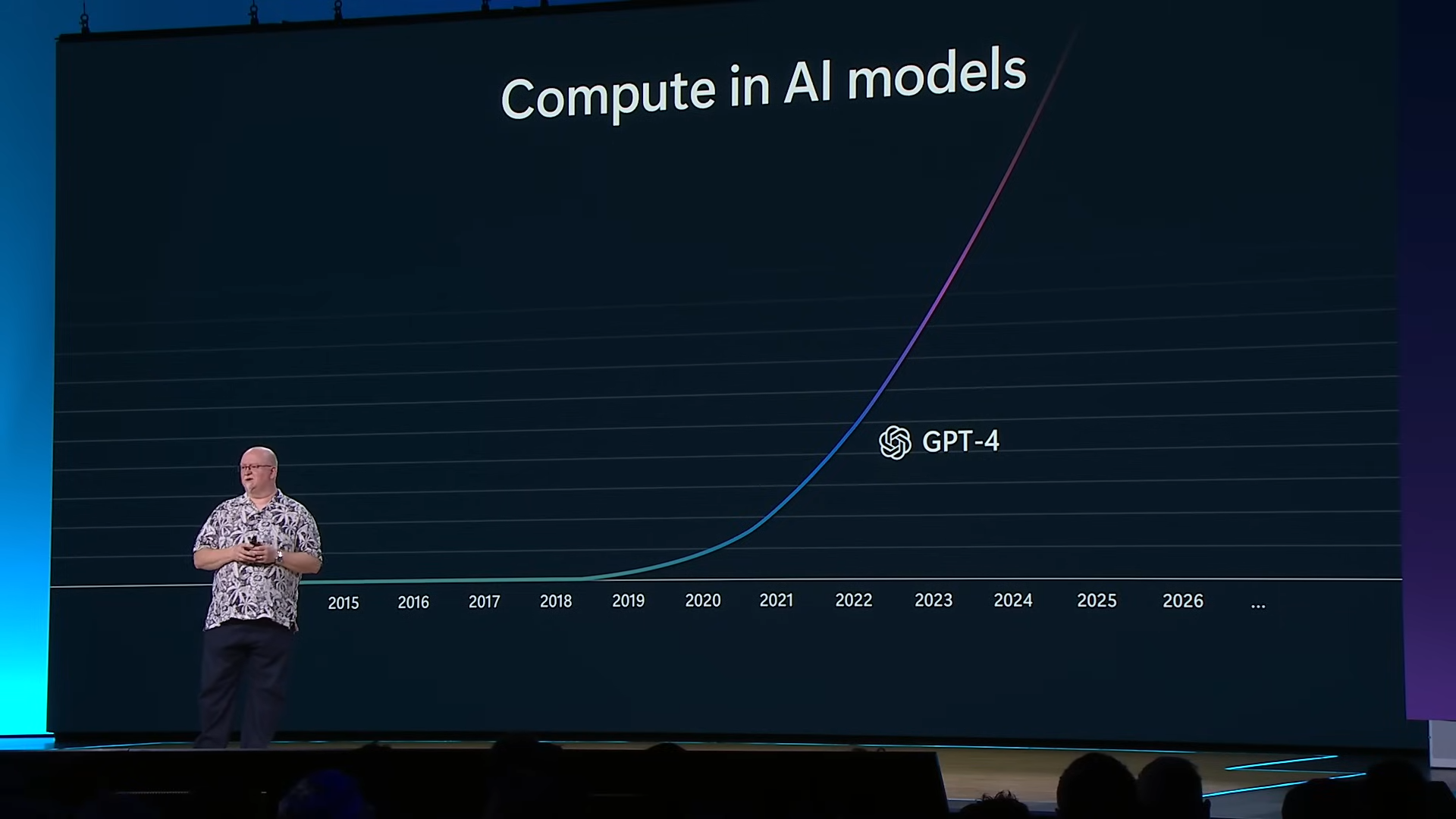

TSMC CEO C.C. Wei says OpenAI CEO Sam Altman's plans to build new fabs for AI chips were "too aggressive" for his company. Altman reportedly proposed last year to build about three dozen fabs to meet the growing demand for AI services. TSMC declined, saying Altman's proposed number of fabs was too high and that it feared it would not be able to operate them at the required utilization rate of at least 80 percent. TSMC's projections at the time did not see enough demand for more than 30 new fabs. In January, the Financial Times and Bloomberg reported that Altman was planning a global chip network and was talking to several partners, including TSMC.

Read full article about: Elon Musk redirects Nvidia chips for Tesla to xAI

Elon Musk rerouted Nvidia AI chips from Tesla to his AI company, xAI. Internal Nvidia emails obtained by CNBC show that Musk ordered the delivery of 12,000 GPUs with priority to X and xAI instead of Tesla. According to CNBC, this delays the delivery of more than $500 million worth of chips to Tesla by months, potentially hindering the development of the infrastructure needed for autonomous driving and robotics. In a post on X, Musk explained that "Tesla had no place to send the Nvidia chips to turn them on, so they would have just sat in a warehouse." Redirecting the scarce chips illustrates Musk's conflict of interest between Tesla and his AI ambitions. Musk has demanded more Tesla stock in the past, at least 25%, to invest more in AI within the company. It's all about controlling a potential key technology: Musk is the sole ruler of xAI.

Read full article about: Microsoft invests more than three billion US dollars in generative AI in Sweden

Microsoft is investing $3.2 billion over two years in cloud and AI infrastructure in Sweden. The company will deploy up to 20,000 Nvidia graphics processors, likely AMD processors, and possibly its own chips in its data centers to meet the growing demand for generative AI, Reuters reports. Microsoft also plans to train 250,000 Swedes in AI skills and invest in local renewable energy. President Brad Smith announced additional investments for this fall. The investment joins multi-billion dollar investments in Germany, Spain, Japan, Southeast Asia and the U.S., totaling more than $15 billion.