AI valuations soar past dotcom-era highs

Key Points

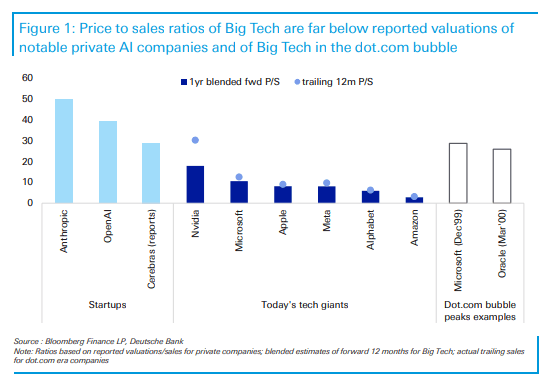

- An analysis by Deutsche Bank shows that the valuations of leading AI start-ups in relation to their revenue even exceed the highs of the dotcom era.

- While companies such as Microsoft and Oracle achieved price-to-sales ratios of around 30 during that time, the values of AI companies are sometimes twice as high.

- ChatGPT developer OpenAI is valued at $157 billion after a financing round - almost 40 times its estimated annual revenue. Anthropic's target valuation is even more extreme at 50 times its most generous revenue forecast.

A new analysis reveals that valuations of leading AI companies compared to their revenues have surpassed peak levels seen during the dotcom bubble.

Deutsche Bank's study shows AI startup valuations in relation to revenue are reaching heights that dwarf even the most extreme excesses of the dotcom era. The analysis uses estimated revenue for the next 12 months for AI companies and trailing revenue for dotcom-era firms.

The comparison to dotcom peak values is particularly striking. While companies like Microsoft and Oracle achieved price-to-sales ratios around 30 back then, current AI startup valuations are exceeding those figures, in some cases by double.

OpenAI, the company behind ChatGPT, recently raised $6.6 billion at a $157 billion valuation, plus a $4 billion credit. With estimated annual revenue of about $4 billion, this is nearly 40 times gross revenue. According to investor documents, OpenAI expects to grow rapidly, targeting $100 billion in revenue by 2029.

Anthropic's valuation appears even more extreme. Backed by Amazon and Alphabet, the OpenAI spinoff is reportedly seeking a valuation up to $40 billion - 50 times its most optimistic annualized revenue forecast of $800 million.

Bubble concerns

The sky-high valuations are raising questions about sustainability. Some see parallels to the dotcom bubble and warn of potential market overheating.

Lisa D. Cook, a Federal Reserve governor, urges caution on short-term AI productivity forecasts. She emphasizes uncertainties about economic impact and notes that implementing AI in business practices takes time.

Others argue the valuations could be justified by AI's enormous potential. They point to AI's broad applicability across industries and possible disruptive effects on existing business models.

Bret Taylor, OpenAI's chairman and former Facebook CTO, takes an optimistic view. While seeing parallels to the dotcom era, he argues many of the most optimistic predictions about the internet's transformative power have come true long-term.

"I think we are in a bubble, but bubbles have different shapes. There's a Mark Twain quote that history doesn't repeat itself, but it rhymes. I think the AI bubble will rhyme with the dot-com bubble, and I believe with the benefit of hindsight, most of the excess of the dot-com bubble might have been justified," Taylor said.

He believes at least one "brand defining likely trillion dollar consumer company come out of this" and "0 plus enterprise software companies" will emerge from the AI era. However, he acknowledges we'll likely still "laugh at some of the excess" in hindsight.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe now