Goldman Sachs blunder adds to AI stock sell-off

A flawed analysis by Goldman Sachs on ChatGPT's traffic decline caused market jitters. But the data was misread. Demand for OpenAI's services continues to grow.

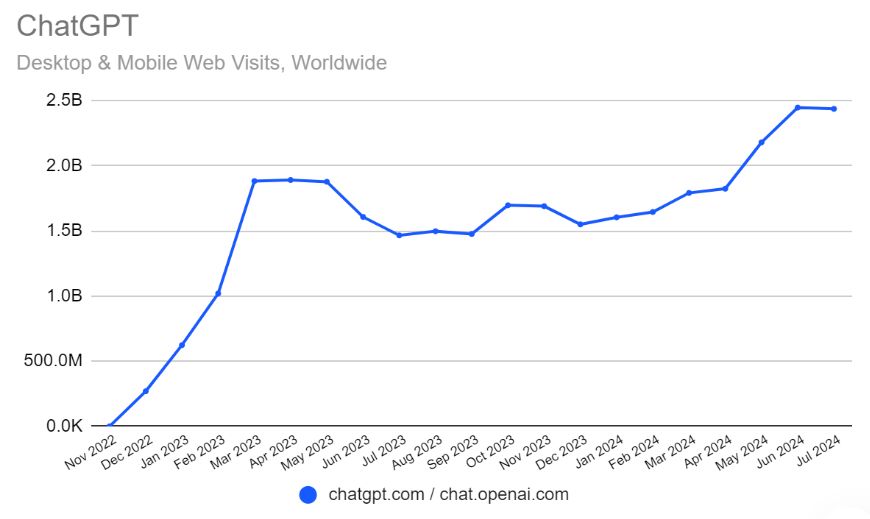

A report by Goldman Sachs analyst Peter Oppenheimer added to the AI bubble story that's preoccupying financial markets. A chart in the report suggested that traffic to OpenAI's popular ChatGPT had plummeted in recent months. The Financial Times picked up the graphic, contributing to negative sentiment around AI stocks.

However, this was an error by the renowned investment bank. Goldman Sachs used data from Similarweb for the analysis but failed to account for OpenAI's recent domain change from chat.openai.com to chatgpt.com. Traffic to chat.openai.com naturally declined as a result.

In fact, Similarweb's own monthly AI service usage analysis paints a very different picture: ChatGPT saw 66.2% year-over-year growth and remains by far the most popular generative AI application. Competitors like Anthropic's Claude and Perplexity are gaining ground but haven't yet caught up to ChatGPT.

Other indicators also point to strong demand for OpenAI's services. The company recently announced 200 million weekly active users - double the number from November 2022. Corporate business is growing, as is the use of OpenAI models via APIs. And then there are Microsoft applications that use OpenAI models, such as Github Copilot, which has also seen good growth.

Declining AI demand is not OpenAI's problem

OpenAI faces challenges, from occasionally naive communication to frustrated safety researchers and high costs. But lack of demand doesn't seem to be one of those challenges right now.

A recent analysis suggests OpenAI could generate revenue between $3.5 and $4.5 billion this year - impressive for a company that only began serious commercial operations in late 2022. However, this comes with costs of up to $8.5 billion.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe nowAI news without the hype

Curated by humans.

- Over 20 percent launch discount.

- Read without distractions – no Google ads.

- Access to comments and community discussions.

- Weekly AI newsletter.

- 6 times a year: “AI Radar” – deep dives on key AI topics.

- Up to 25 % off on KI Pro online events.

- Access to our full ten-year archive.

- Get the latest AI news from The Decoder.