Investors warn of AI chip bubble as AMD and D‑Matrix keep the boom alive

Warnings of an AI chip bubble are growing louder, driven by the short lifespan of hardware and risky financing. At the same time, new investments and optimistic forecasts show the boom is not over yet.

The AI chip market is showing increasingly contradictory signals: On one hand, investors like Michael Burry, known for his bets against the U.S. housing market, are warning of a bubble fueled by massive investments in short-lived hardware. On the other hand, optimistic growth forecasts and high investments in new companies suggest the boom is still unbroken.

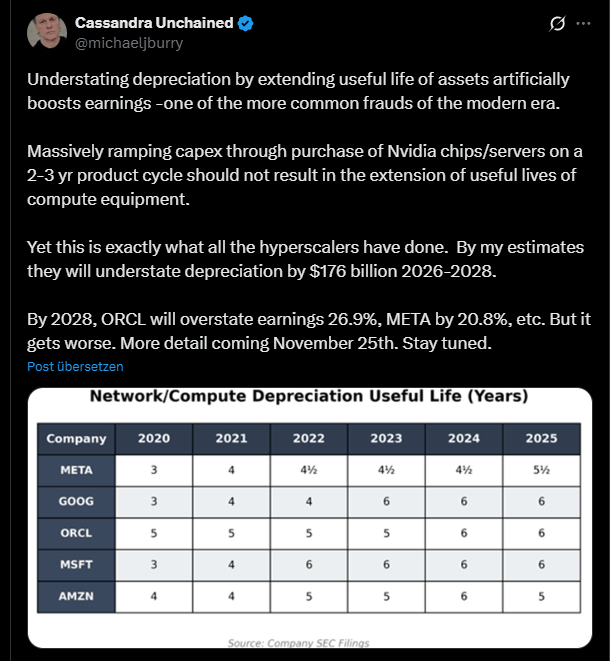

According to Burry, the short lifespan of graphics processing units (GPUs) is a central problem. He issued a stern warning on X about the accounting practices of hyperscalers. In Burry's view, many companies are artificially extending the depreciation period of their AI hardware to report higher short-term profits. Specifically, he states that extending the useful life of capital goods like GPUs to, for example, five or even seven years is not justified given the rapid innovation cycles and the rapid depreciation of these chips.

Burry calls this practice "one of the more common frauds of the modern era" and warns that the rapid product cycle of Nvidia chips—with new generations often only two to three years apart—is not economically reflected by a longer depreciation period. According to Burry, companies that nevertheless keep their hardware on the books for longer are obscuring the actual costs and risks of their investments.

According to his calculations, these corporations will understate depreciation by about $176 billion between 2026 and 2028 alone. This results in the reported earnings of tech giants like Oracle and Meta appearing to be overstated by more than 20 percent. Burry sees this as a systemic risk factor that could threaten the stability of the entire AI market should the pace of growth slow or demand for computing power stagnate.

Financial risks and operational glitches fuel bubble concerns

According to Bloomberg, private credit funds are also increasingly using GPUs as collateral for loans to so-called "neoclouds"—startups that rent out computing power. An example of the associated risks is CoreWeave: As CNBC reports, the company's stock plummeted 16 percent after delays at a data center partner impacted its full-year revenue forecast. The stock of the alleged partner, Core Scientific, also fell by 10 percent.

Additionally, SoftBank Group has sold its entire stake in Nvidia, worth $5.83 billion, to finance its own AI projects. This is an apparently necessary financing measure that underscores the immense capital requirements in the AI sector.

Growth forecasts and new investments defy the warnings

Despite the concerns, sentiment in parts of the market remains optimistic. AMD is forecasting accelerated revenue growth averaging over 35 percent per year for the next three to five years. CEO Lisa Su expects revenue in the AI data center segment to grow by an average of 80 percent over the same period.

At the same time, fresh capital continues to flow into the sector. The Microsoft-backed AI chip startup D-Matrix has raised $275 million in a new funding round at a $2 billion valuation. The company focuses on chips for AI inference, which is the execution of trained models. Investors include sovereign wealth funds from Qatar and Singapore.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe nowAI news without the hype

Curated by humans.

- Over 20 percent launch discount.

- Read without distractions – no Google ads.

- Access to comments and community discussions.

- Weekly AI newsletter.

- 6 times a year: “AI Radar” – deep dives on key AI topics.

- Up to 25 % off on KI Pro online events.

- Access to our full ten-year archive.

- Get the latest AI news from The Decoder.