17 new companies join top 50 consumer AI apps in latest a16z rankings

A new report from venture capital firm Andreessen Horowitz (a16z) reveals major shifts in the consumer AI landscape, with established players gaining momentum and new specialized tools emerging across video and developer categories.

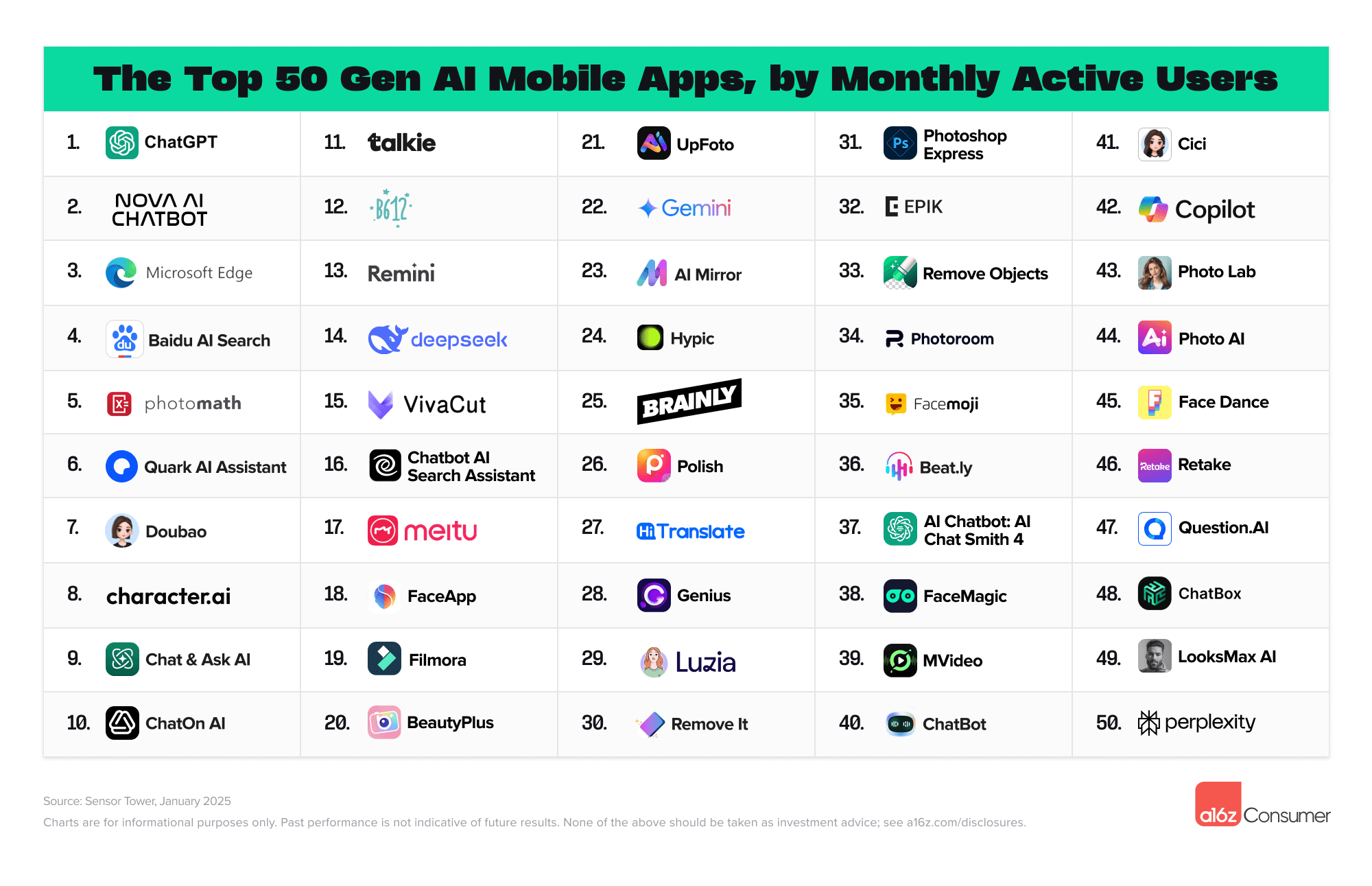

The firm's biannual rankings track the top 100 consumer AI applications, using Similarweb data for web visits and Sensor Tower data for mobile usage. The latest ranking shows significant movement, with 17 new companies joining the top 50 since August 2024.

The rankings now focus exclusively on AI-native applications, removing platforms like Canva and Notion that added AI features later. Traditional photo editors like Pixlr, Fotor, and PicsArt have also been excluded. A new "Brink List" highlights 10 promising companies that nearly reached the top 100, including Runway, Krea, and Lovable.

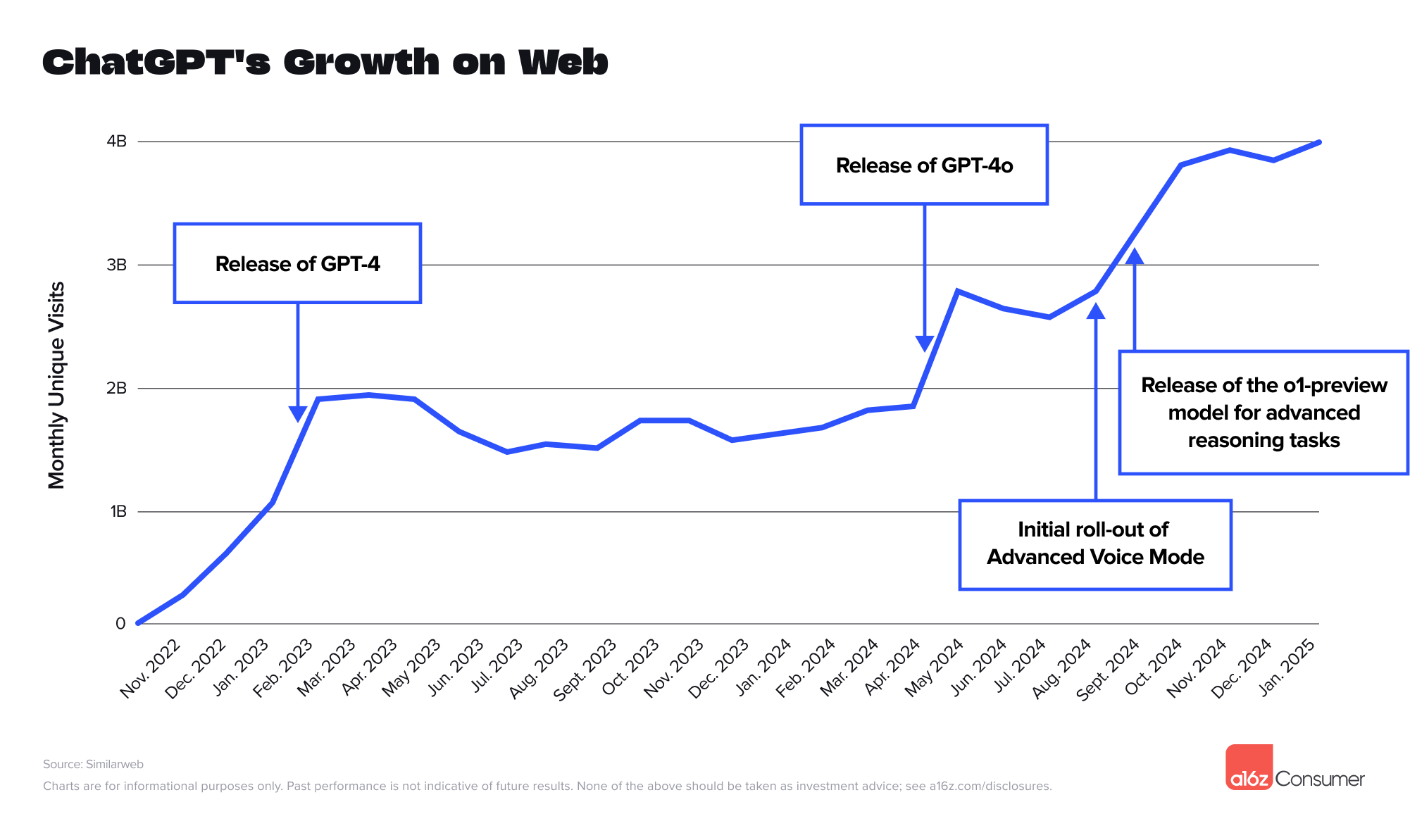

ChatGPT doubles user base with new features

OpenAI's flagship product has rebounded from earlier stagnation, reaching 400 million weekly active users in February 2025 - twice its user count from six months earlier, though growth has recently plateaued again.

The venture firm attributes the growth to ChatGPT's Advanced Voice Mode and first reasoning model, o1. According to Sensor Tower data, the mobile app now accounts for nearly half of all ChatGPT users.

Deepseek has rapidly risen to become the second most popular AI product globally as of January 2025. Backed by Chinese hedge fund High-Flyer, the company has found strong adoption in China, where ChatGPT is banned. The company claims to achieve its performance while spending less on training than its competitors.

AI video generation emerges as new growth category

AI-generated video has emerged as a breakthrough category in the rankings. Three newcomers - China's Hailuo and Kling AI, plus OpenAI's recently launched Sora in Europe - are now in the top 50.

The report also highlights surging interest in AI tools for developers and "vibecoders" - users who want to create with AI without traditional programming skills. Development environments like Cursor that integrate language models directly, and text-to-web platforms like Bolt have seen explosive growth. Tech-savvy users can combine both approaches, creating initial prototypes in Bolt before refining the code in Cursor.

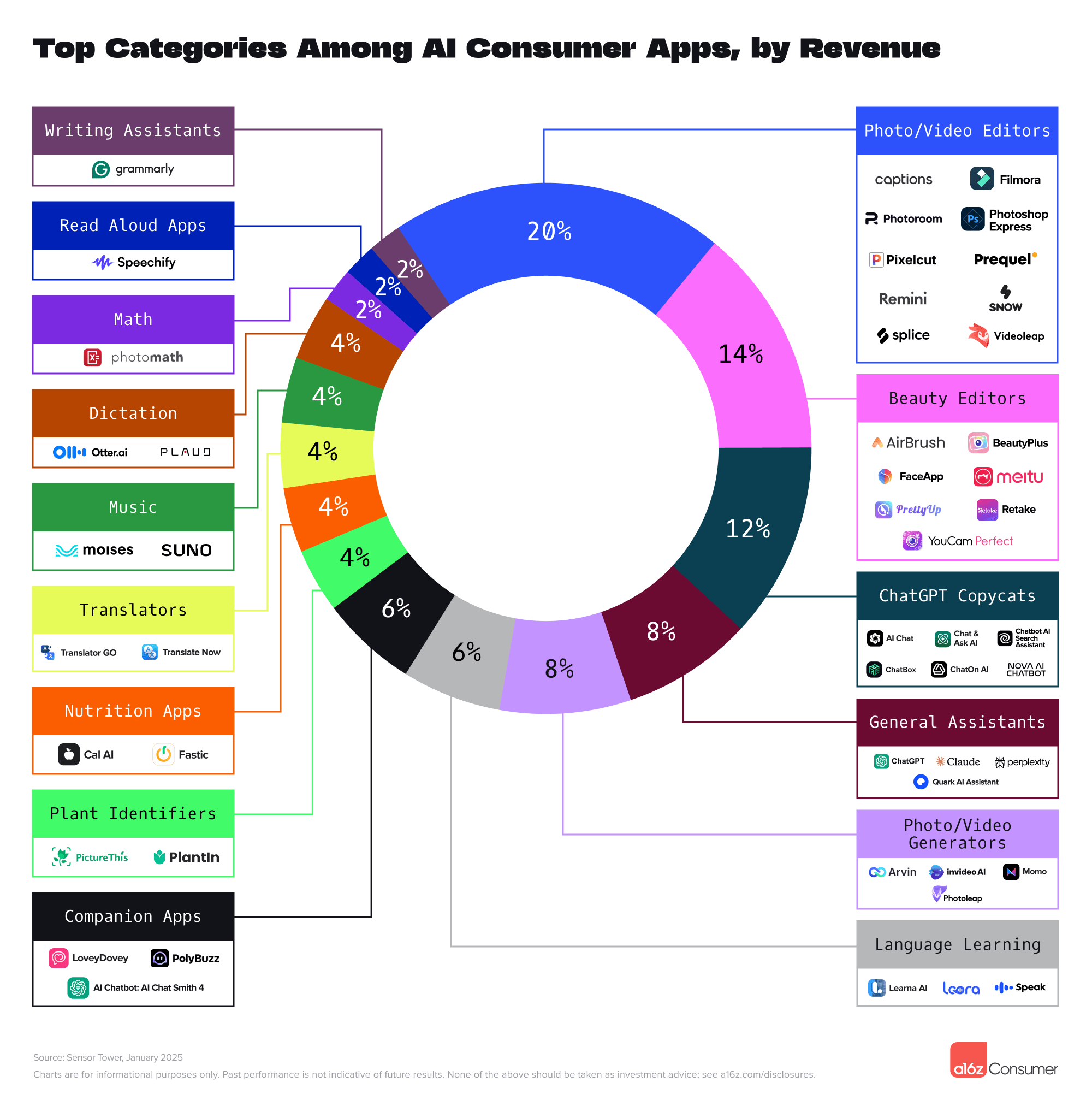

Usage and revenue show different leaders across categories. While some apps dominate in user numbers, they don't necessarily lead in revenue generation, a16z reports. Video editing tools, for instance, have different top performers when ranked by users versus revenue. Several categories, including plant identification and nutrition apps, make the revenue rankings despite having fewer users overall.

AI News Without the Hype – Curated by Humans

As a THE DECODER subscriber, you get ad-free reading, our weekly AI newsletter, the exclusive "AI Radar" Frontier Report 6× per year, access to comments, and our complete archive.

Subscribe nowAI news without the hype

Curated by humans.

- Over 20 percent launch discount.

- Read without distractions – no Google ads.

- Access to comments and community discussions.

- Weekly AI newsletter.

- 6 times a year: “AI Radar” – deep dives on key AI topics.

- Up to 25 % off on KI Pro online events.

- Access to our full ten-year archive.

- Get the latest AI news from The Decoder.