Update, March 9, 2026:

OpenAI released the following statement:

Caitlin Kalinowski was not the head of all robotics at OpenAI. She was responsible for hardware and operational topics within the Robotics Division. She was also not a researcher and did not lead Robotics Engineering. The Robotics Division is led by Aditya Ramesh, while the Consumer Hardware Division is headed by Peter Welinder.

Original article from March 8, 2026:

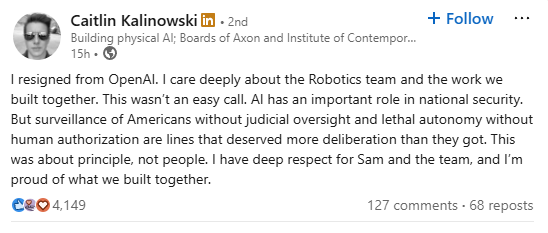

OpenAI's hardware and robotics chief Caitlin Kalinowski resigned over the company's military collaboration, announcing her decision on LinkedIn and X. She says surveillance without judicial oversight and lethal autonomy without human sign-off "deserved more deliberation than they got." Kalinowski joined from Meta in November 2024, where she built the Orion AR headset.

Her departure follows a contract between OpenAI and the Pentagon giving the military access to its models, a deal Anthropic had already rejected over safety concerns. OpenAI says the contract includes the same hard red lines against mass surveillance and autonomous weapons that Anthropic demanded. But the company agreed to softer "all lawful use" language that still leaves room for interpretation. The US government now wants to make that wording standard for all AI companies working with the state.